How do I access my payslip?

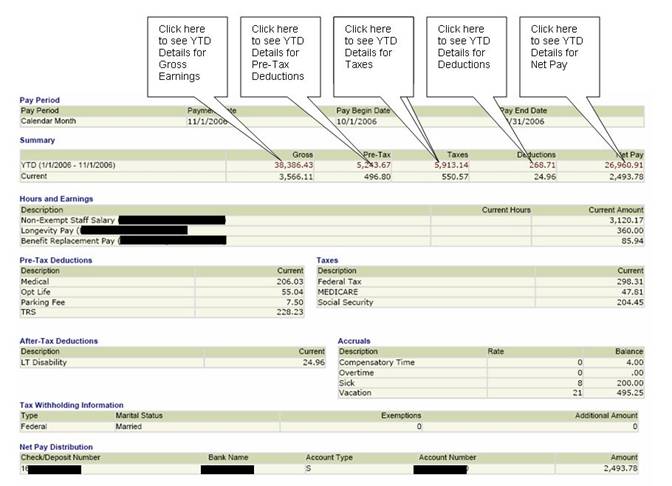

To access your portal payslips, please log in to Pioneer Portal, My Info, and Payslip Information. Please see below screenshots for further information.

What does a Pre-Tax Deduction mean?

These amounts are reduced from your gross income prior to calculating your taxable income and your tax withholdings. The following deductions are pre-tax deductions for both federal income tax and social security/medicare withholdings:

- Medical

- Dental

- Basic Life

- FSA Dependent Care

- FSA Medical

- Optional Life

- Parking

- Voluntary Accidental Life & Dismemberment

The following deductions are pre-tax deductions for federal income tax:

How is Longevity Pay calculated?

Each regular full-time nonacademic employee of TWU who qualifies under the eligibility provisions of this policy, shall be entitled to longevity pay at the rate of $20 per month for every two years of lifetime service credit as an employee of the State up to and including 42 years of service. Such pay shall commence at the end of the second year of State service and shall be increased at the end of each two years thereafter.

What is Taxable GT Life?

Employer provided group-term life insurance coverage with a value of $50,000 or less is a tax-free benefit to the employee if it is provided in a nondiscriminatory fashion. The value of the coverage in excess of $50,000, less any employee after-tax payroll deductions, is taxable income.

When will my parking deductions occur?

The parking deductions occur over your normal assignment period. For faculty with a nine month assignment, your parking deductions will be taken over nine months. For faculty electing to spread pay over the 12 month period and for all staff, your deductions will be taken over 12 months. All deductions will start on your October 1st paycheck.

How is the salary for Adjunct Faculty spread over the semester?

For the fall semester, the assignment period is from September 1 through December 31 and the salary is paid in four monthly payments on the first working day of October, November, December, and January.

For the spring semester, the assignment period is from January 16 through May 15 and the salary is paid in five payments with a partial month’s pay on the first working day of February, monthly payments on the first working day of March, April, and May and a partial month’s pay on the first working day of June.

For the summer semester, the assignment period if from June 1 through August 31 and the salary is paid in three monthly payments on the first working day of July, August, and September.

Who do I contact if I have questions about my payslip?

You can call the Payroll office at 940-898-3561 or email one of following Payroll employees:

Nature Miller nmiller11@twu.edu

Amanda Noday anoday@twu.edu

Who do I contact if I have questions about my benefit deductions?

You can call the Benefits office at 940-898-3542 or email one of the following Benefit employees:

Brenda Villarreal bvillarreal1@twu.edu

Angela Cagle acagle@twu.edu

W-2 Forms

When will the W-2 forms distributed?

The W-2 forms will be mailed to the home addresses on or before January 31st of each year.

Are the W-2 forms available online?

The W-2 forms are available online. To access your W-2 online, go through Phoenix, TWU Employee Self-Service, and W-2 Information once they become available.

Can the online line W-2 form be utilized to file my taxes?

Yes, the online line W-2 can be utilized to file your taxes.

Why doesn’t my W-2 form agree to the gross income on my payslip? Why doesn’t my W-2 form agree to my annual salary?

Box 1 (Wages, tips, other compensation) on the W-2 form is your taxable income. Your taxable income can be obtained by reviewing your final payslip for the year (for most employees, this will be your 12/1 payslip) and subtracting the YTD Pre-Tax Deductions from your YTD Gross Income.

What is the difference between Box 1 and Box 3 on my W-2 form?

Box 1 is your taxable income for federal income tax and Box 3 is your social security wages. The difference between these 2 amounts is any pre-tax retirement contributions such as ORP, TRS, 403(b) or 457 contributions.

Hiring Out of State

Can I hire a faculty member residing out of state?

At this time, we are unable to support the hiring of graduate assistants or adjunct faculty members from out of state. We do allow the hiring of full-time faculty working out of state.

Please refer to UPR:III.11.c Employing Faculty Residing Outside of the State of Texas.

What states are we currently registered with that have a state income tax?

- Alabama

- Arizona

- Arkansas

- Colorado

- Connecticut

- Georgia

- Illinois

- Indiana

- Louisiana

- Maryland

- Massachusetts

- Missouri

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- Tennessee

- Utah

- Virginia

- Washington

- Washington D.C.

Are there states without a state income tax?

Yes. The states without state income tax are listed below:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Texas

- Tennessee

- Washington

- Wyoming